Ver en Español

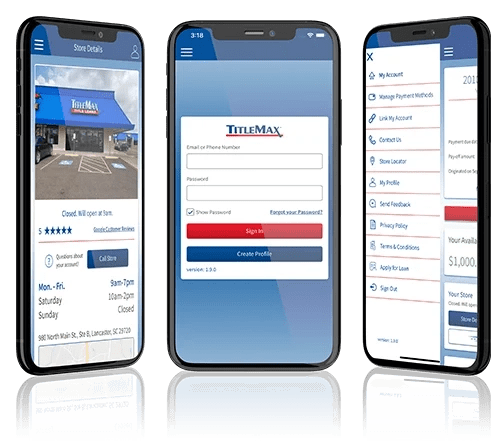

At TitleMax®, we’re committed to providing the best customer experience possible. So if you have any questions, comments, or concerns, we want to hear from you. There are multiple ways for you to reach us. Just choose the option that works best for you below. Our customer care associates are able to assist with any questions about our Title Loans/Pawns and additional products or services.

If the options below won’t work for you, we also have lots of stores across the country and our friendly associates are happy to help with any questions you may have. Find the TitleMax® closest to you on our Locations page!

We have our New Loan Servicing Department available during the following days/hours:

If you are an existing customer and have questions:

Contact us at 800-804-5368.

For general questions about our products or services:

Contact us at 1-88 TITLEMAX.

If you have questions or need assistance with your Online Loans:

Contact us at 1-888-869-4522.

If you would like to write us, please send your letter to:

Legal Department

15 Bull Street

Savannah, Ga. 31401

Chat Live Now with one of our representatives.

Visit our Discovery Center for fun facts, infographics and more.

Read Articles from the Discovery Center

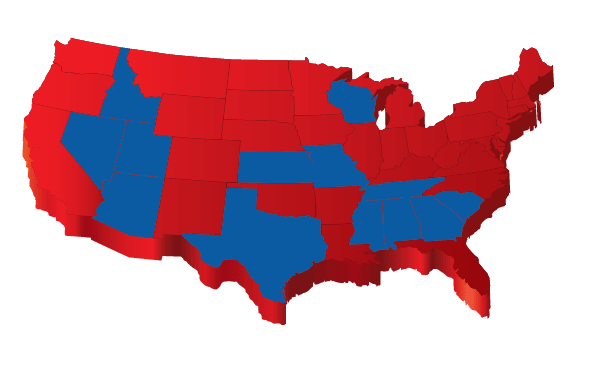

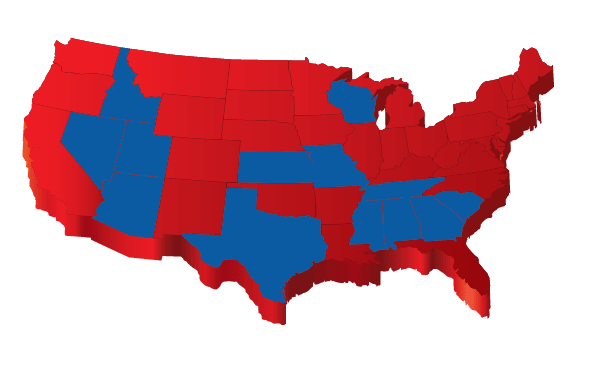

TitleMax services, products, and funded amounts vary and are not available in all stores or states.

2 Personal Unsecured Loans/LOCs: Unsecured loan amounts and products not available in all stores/states. First time maximum for new personal loan customers varies by state; first time max is $600 in MS; $800 in SC; $1000 in other markets. Higher amounts may be available for return borrowers. In-Store: In-person application not available in the state of Idaho at this time. Account approval requires satisfaction of all eligibility requirements, including a credit inquiry. Bring in active bank account details (dated within the last 60 days), and a valid government-issued ID to apply. If your bank account statement does not show recurring income deposits, you will need to also bring in proof of income, like a paystub, from within the last 60 days. In NV, proof of gross monthly income is required in addition to a bank statement. In AZ, a valid AZ motor vehicle registration in your name is also required. Min funded amount is $601 in SC. For new personal/unsecured loan customers without SSN or ITIN, max loan is $350 ($601 in SC). Online: If you do not have an SSN or ITIN, please visit us in store to apply. Additional items required for eligibility, including: a valid and active email address and telephone number, and a valid SSN. You must also reside in a state in which we do business (currently AZ, DE, ID, KS, MO, MS, SC, TX, UT or WI). Min funded amount is $610 in SC. Certain other terms and conditions may apply.

– Funds distributed via ACH to the borrower’s debit card, Dash® Prepaid Card or MoneyGram® (when/where available). The Prepaid Technologies Mastercard Prepaid Card is issued by Pathward, N.A., Member FDIC pursuant to a license by Mastercard International Incorporated. The card may be used everywhere Debit Mastercard is accepted.

– California, Illinois, New Mexico and Virginia Residents: TitleMax® no longer originates new loans in CA, IL, NM or VA, but continues to service existing loans.

– In Georgia, TitleMax offers Title Pawns.

– In Idaho, TitleMax only offers an online personal line of credit. In-person loans/applications are not available at this time.

– In Nevada, title loans and high interest loans should be used for short-term financial needs only and not as a long-term financial solution. Customers with credit difficulties should seek credit counseling before entering into any title loan or high interest loan transaction. Ability to repay analysis with income documentation required. Proof of gross monthly income required for a personal loan. A Nevada state-wide database check is required as a condition to getting a title loan or high interest loan in Nevada.

– In Tennessee, TitleMax offers title pledges and secured Lines of Credit (“LOC”). Only one LOC account allowed per customer, inclusive of other lenders. LOC customers are subject to a periodic income (and collateral, if applicable) review/validation.

– TitleMax of Texas, Inc. and TitleMax Online of Texas, Inc., d/b/a TitleMax act as Credit Services Organizations to assist customers in obtaining a loan through an unaffiliated third-party lender. Please see store associate for details. Please see Texas Schedule of All Fees. TitleMax does not offer pawn loans or pawn transactions in Texas.

– To opt out of selling by clicking Do Not Sell My Personal Information .

– TitleMax®, TitleBucks®, and InstaLoan®, are not considered competitors. Please see a store associate for details.